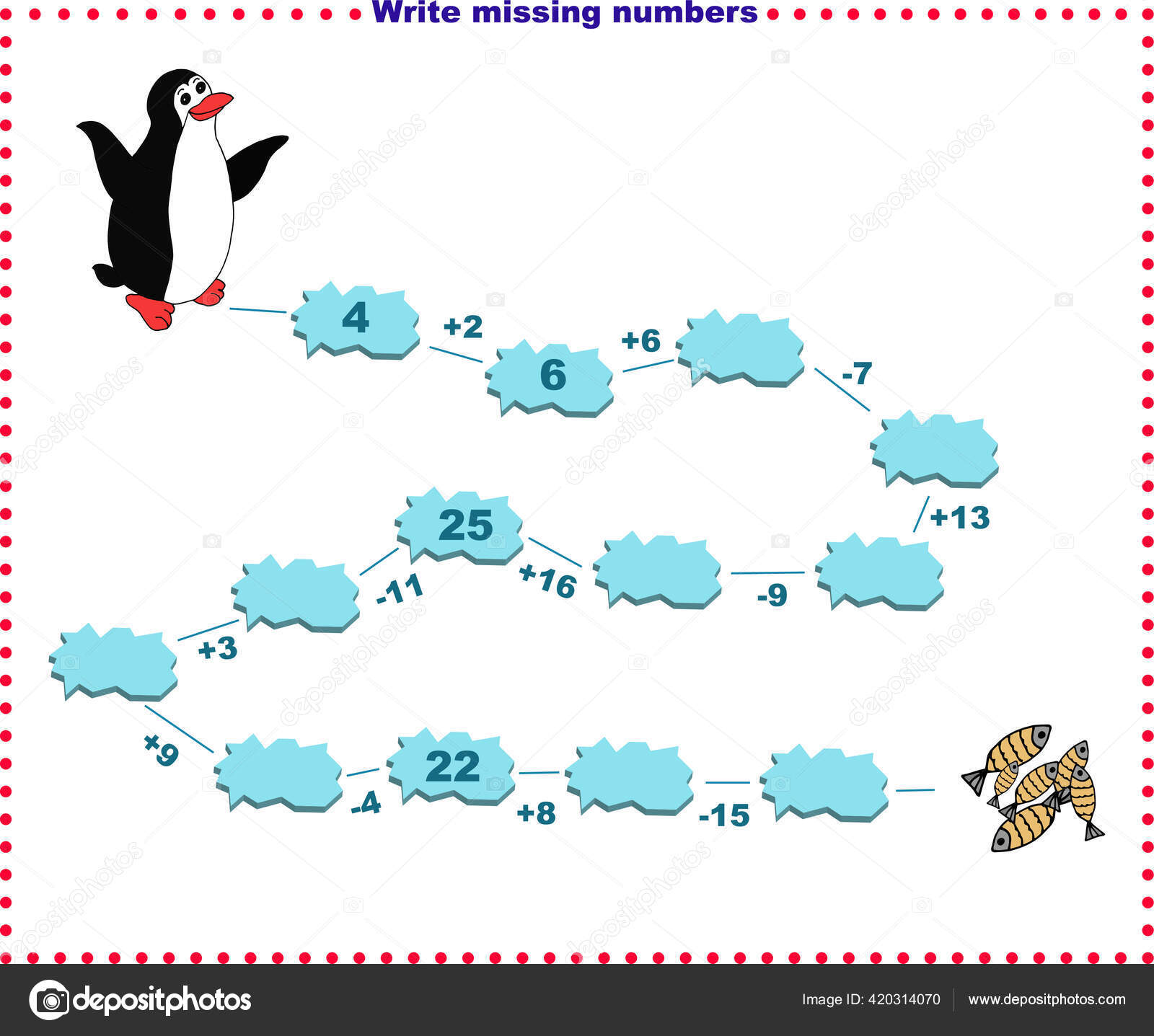

Now find the sum of all the elements in the array and subtract it from the sum of first n natural numbers, it will be the value of the missing element.

So the sum of all n elements, i.e sum of numbers from 1 to n can be calculated using the formula n*(n+1)/2.

This could happen if they get a missing W-2 after they file. Taxpayers may need to correct their tax return. This way, the taxpayer won’t have to file a separate extension form and will receive a confirmation number for their records. Taxpayers can also get an extension by paying all or part of their estimated income tax due, and indicate that the payment is for an extension using Direct Pay, the Electronic Federal Tax Payment System, or a credit or debit card. Taxpayers should remember that an extension of time to file isn’t an extension of time to pay taxes owed. Taxpayers can also e-file a request for more time using IRS Free File. To request more time to file, they should use Form 4868, Application for Automatic Extension of Time to File. They should estimate their wages and taxes withheld as best as possible. If they still haven’t received their W-2, they should use Form 4852, Substitute for Form W-2, Wage and Tax Statement. Taxpayers should file their tax return by April 17, 2018. Estimate of wages and federal income tax withheld in 2017.Employer’s name, address and phone number.Name, address, Social Security number and phone number.The IRS will send a letter to the employer on taxpayers’ behalf. Taxpayers who are unable to get a copy from their employer by the end of February may call the IRS at 1-80 for a substitute W-2.

Be sure the employer has the correct address. Taxpayers should ask their current or former employer for a copy of their W-2. Taxpayers who haven’t received their W-2 by the end of February should: Taxpayers need their W-2s to file an accurate tax returns, as the form shows an employee’s income and taxes withheld for the year. Most taxpayers got their Form W-2, Wage and Tax Statement, by the end of January.

0 kommentar(er)

0 kommentar(er)